Steps to Selecting Trusted Forex Brokers

There are a lot of reasons why traders are looking for trusted forex brokers. If you are trading in Forex, you would not want to take risks with your investments. You are constantly monitoring market movements and the price movements of currencies. The Forex market is also highly volatile, thus traders always look for brokers that can make them have a sense of security. Trustworthy brokers provide this sense of security to traders.

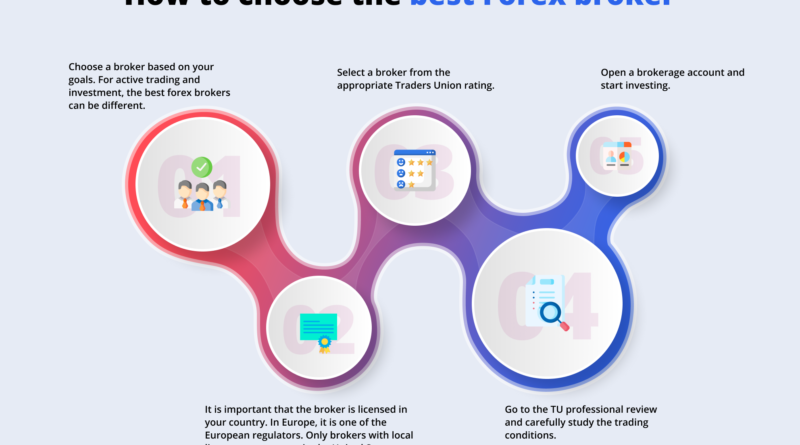

With that said, there are several factors that determine whether brokers are trusted forex brokers or not. It’s up to the trader to find out how does forex trading work, which brokers are trustworthy and which brokers are not. Here are some factors that will help you determine which brokers are reliable and which brokers are not.

- The most important thing that determines whether a broker is trustworthy or not is by reading reviews about their service and their track record. When you are reading reviews online about forex brokers, you will notice that most of the reviews are from veteran traders that are still trading actively. These traders can easily attest to the reliability of a forex broker based on the way they have managed their trading accounts. More importantly, if a forex broker has had good results in their trading account, you can be sure that they will have good results in your trading account as well.

- If you are going to rely on reviews alone, then it’s important to realize that they are not absolute. You will need to do more than just read review in order to determine whether a broker is trusted forex brokers or not. You will need to contact the broker in question and find out if they are free to answer your queries, and if they are able to provide you with assistance in case you experience problems while trading.

- Check with other traders and experts in the field to see if they have any recommendations for trusted forex brokers. Remember, when looking for an advisor to help you start trading, you don’t want to follow the advice of someone who started trading years ago and hasn’t made much money yet. For instance, if you want to start trading forex trading, you shouldn’t follow the advice of someone who has traded manually with a demo account. This means you should avoid forex trading advisors who haven’t even created a platform for trading yet. Instead, you should look for people who are active traders who can show you how to get started with forex trading by developing a trading platform.

- Find trusted forex brokers by joining forex trading forums and discussions online. Again, when dealing with forex brokers, you need to check with other forex traders. Remember, they will be able to give you their honest opinions. Also, remember that it’s important to only get the top level brokers. If you manage to find brokers who are at the top of the trading ladder, this is because they are in fact experienced traders who understand the risks associated with trading currency. They have also developed expert skills which you should also take into consideration when selecting a trusted crypto search.

Forex Broker – Information And Advice

In forex, currencies are traded back and forth in relation to each other based on the current value of the exchanged currencies. This market acts as a very liquid market due to its ability to trade large amounts of foreign currency at the same time.

The foreign exchange market acts similarly to the stock market, however it is more volatile due to the ability to trade large amounts of currencies at the same time. Unlike the stock market, the forex broker will offer you access to pairs of currencies that you wish to trade. You may find that trading certain pairs is better than trading other pairs. For instance, if you find that the Japanese yen is rising in value, you may want to trade that pair compared to the euro or the dollar because you stand to profit more on the currencies that are rising in value as opposed to those that are falling in value.

There are many more brokers to choose from, and they all have their own unique styles. However, there are some things that you should look for when choosing which brokers to trade with. These brokers will offer you access to numerous international markets where you can trade with currencies from around the world. They will also offer you information about how the pairs you trade are derived from the major economies around the world.

Another thing that you should look for in a forex broker is whether or not they use an interbank system. An interbank system allows brokers to trade your account without charging you fees. This means that you will be able to get a better deal on trading costs and you will be able to save money on the commissions that you would normally pay to brokers. In order to get a good deal, however, it is important that you do your homework and find a broker with the best interbank system available.

Before you decide on a forex broker, you should also take a look at the forex broker commission that they charge you. Some brokers will charge you a flat fee for trading, but many brokers will charge a fee per currency that you trade with. The difference between the two is that the flat fee will be considerably lower than the combined charges that you would pay if you were to trade five different currencies on the same account. Finally, before you choose a forex broker, you should also consider the fact that you should visit the brokers websites and read their terms and conditions so that you understand what you are agreeing to. This will ensure that you are happy with the broker once you start trading.