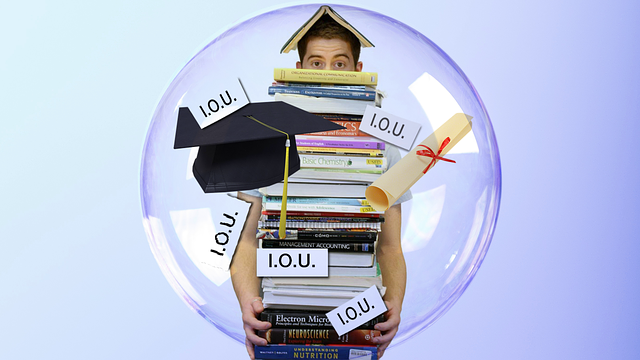

Don’t Understand Student Loans Read This Piece

Many people today would love to attend school, but because of the high costs involved they fear that it is impossible to do so. If you are here because you are seeking ways to afford school, then you came to the right place. Below you will find good advice on how to apply for a student loan, so you can finally get that quality education you deserve. Think carefully when choosing your repayment terms. Most public loans might automatically assume a decade of repayments, but you might have an option of going longer. Refinancing over longer periods of time can mean lower monthly payments but a larger total spent over time due to interest. Weigh your monthly cash flow against your long-term financial picture. If you Don’t Understand Student Loans Read This Piece.

Tips for Student Loan:

- You should not necessarily overlook private college financing. Student loans through the government are available, but there is a lot of competition. Private loans – especially small ones – do not have as much competition, and this means that there is funding available that most other people don’t even know about. Check out this type of funding in your community, and you might get enough to cover your books for one semester or maybe even more.

- Do not hesitate to “shop” before taking out a student loan. Just as you would in other areas of life, shopping will help you find the best deal. Some lenders charge a ridiculous interest rate, while others are much more fair. Shop around and compare rates to get the best deal.

- If you are moving or your number has changed, make sure that you give all of your information to the lender. Interest begins to accrue on your loan for every day that your payment is late. This is something that may happen if you are not receiving calls or statements each month.

- Check the grace period of your student loan. Stafford loans offer a period of six months. For Perkins loans, the grace period is nine months. Other types can vary. Know when you are to begin paying on your loan.

- Paying your student loans helps you build a good credit rating. Conversely, not paying them can destroy your credit rating. Not only that, if you don’t pay for nine months, you will ow the entire balance. When this happens the government can keep your tax refunds and/or garnish your wages in an effort to collect. Avoid all this trouble by making timely payments.

- Take the maximum number of credit hours you can in your schedule to maximize the use of your loans. Though full-time student status requires 9-12 hours only, if you are able to take 15 or more, you will be able to finish your program faster. In the grand course of time, you will end up taking out fewer loans.

- It is best to get federal student loans because they offer better interest rates. Additionally, the interest rates are fixed regardless of your credit rating or other considerations. Additionally, federal student loans have guaranteed protections built in. This is helpful in the event you become unemployed or encounter other difficulties after you graduate from college.

- Starting to pay off your student loans while you are still in school can add up to significant savings. Even small payments will reduce the amount of accrued interest, meaning a smaller amount will be applied to your loan upon graduation. Keep this in mind every time you find yourself with a few extra bucks in your pocket.

- To make collecting your student loan as user-friendly as possible, make sure that you have notified the bursar’s office at your institution about the coming funds. If unexpected deposits show up without accompanying paperwork, there is likely to be a clerical mistake that keeps things from working smoothly for your account.

- Many people, especially when returning to school later, end up having student loans with multiple companies. When you consolidate your student loans, you can lump them all together at a much lower interest rate. And, you can often get your payment lowered as well in the process. It makes things much easier.

Final Words:

As stated in the above article, attending school today is really only possible if you have a student loan. Colleges and Universities have enormous tuition that prohibits most families from attending, unless they can get a student loan. Don’t let your dreams fade, use the tips learned here to get that student loan you seek, and get that quality education. If you Don’t Understand Student Loans Read This Piece